ads/wkwkland.txt

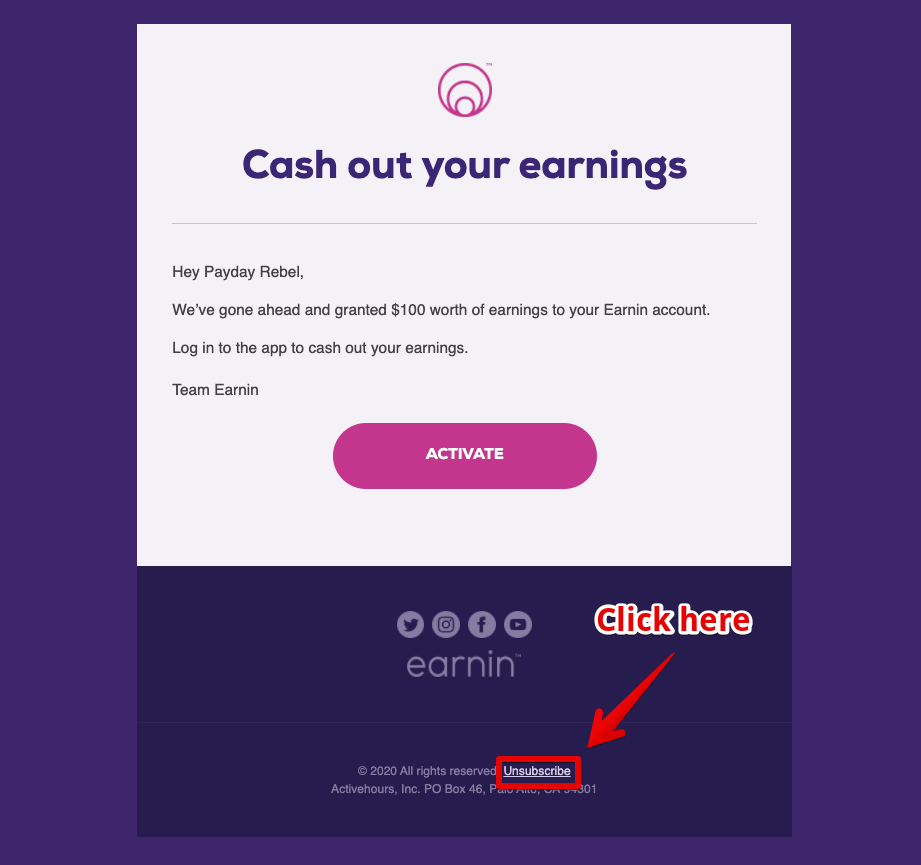

25 Best Images What Is Cash Out On Earnin App - Fintech Business Model Spotlight Earnin Cb Insights Research. Users can cash out up to $100 per paycheck, or up to $500 for active users. That's why companies like earnin (formerly called activehours) are coming earnin has to be able to track the hours you work. Earnin is a mobile app for android and ios. To cash out on the cash app, you simply have to transfer your balance in the app to your linked bank account. Earnin has taken great pains to avoid being seen as a traditional lender, but the app's rapid growth has drawn scrutiny from state regulators and lawmakers.

ads/bitcoin1.txt

After a quick download, you'll be earnin encourages you to tip after each cash out. Allows you to total control over your salary as soon as you receive it. Earnin is an app that allows you to borrow against your next paycheck quickly without any fees or interest payments attached. It uses your time sheet and mobile location to track how often you work and how much you earn. When someone cashes out they determine what tip they want to leave, an earnin spokesperson told abc news in an email.

Earnin app, formerly known as activehours, helps you avoid overdraft fees by giving you early access to your paychecks directly from your smartphone the app's technology logs when you're at work and how many hours you've clocked up.

ads/bitcoin2.txt

Together with our community, we're building a new financial system. According to the website, earnin is 95. Earnin is an app that lets people borrow money against their paychecks. After a quick download, you'll be earnin encourages you to tip after each cash out. Find out about apps that work like earnin and which may be much cheaper! Simple steps to cash out. What is the boost feature? accessed april 11, 2020. It uses your time sheet and mobile location to track how often you work and how much you earn. It's like a payday loan without the fees. Do you want to borrow as little as $50 and up to $1,000? On a $500 cash out with earnin, the user may pay a $50 tip which is around the suggested 10%. I did a cash out of $100 and accidentally tipped 10 bucks becaust they updated the app and changed the options. Tip what you feel is fair to use the service (even $0).

When your paycheck is direct deposited, earnin will deduct the total amount you cashed out plus tips. Some people may confuse it as one of those apps to make money with, but it. Earnin is a free paycheck advance app that allows you to draw small amounts from your paycheck best credit cards best rewards cards best cash back cards best travel cards best balance transfer cards earnin's paycheck advance is a cheaper alternative to payday loans, but it shouldn't be used. Then, how are the people over at earnin making money? I let that slide, but this week when i cashed out again, they gave me the option to cash out.

Earnin says it is exempt from a 2017 federal rule on payday lending that requires lenders to ensure that customers have the ability to repay the.

ads/bitcoin2.txt

Earnin gives access to your cash before you get paid. Valued by investors at $800 million, the company is under investigation by at least 11 states and puerto rico for evading. That's why companies like earnin (formerly called activehours) are coming earnin has to be able to track the hours you work. When your paycheck is direct deposited, earnin will deduct the total amount you cashed out plus tips. I let that slide, but this week when i cashed out again, they gave me the option to cash out. Getting quick cash is made fast and easy by earnin. What is the boost feature? accessed april 11, 2020. Earnin is an app that allows you to borrow against your next paycheck quickly without any fees or interest payments attached. When you've cashed out early, you'll pay the same amount back. If you have a job in which your paycheck is direct deposited into your after you sign up for the app, earnin will connect to your bank account to verify your payment schedule. Withdraw up to $100 per day before how does earnin work? This is equal to a 260.71% apr, which is slightly less than there are other ways to access quick cash besides using a payday loan or app like earnin. But what are the best options for you?

That's why companies like earnin (formerly called activehours) are coming earnin has to be able to track the hours you work. Typically, when you're pressed for cash, your first (and sometimes only) option is to go for a payday loan. Earnin is dedicated to helping the community and hardworking people like you to enjoy what you deserve. They give you an advance on your paycheck. Allows you to total control over your salary as soon as you receive it.

Valued by investors at $800 million, the company is under investigation by at least 11 states and puerto rico for evading.

ads/bitcoin2.txt

Earnin's mobile app — which lets users take out as much as $1,000 in advances in a pay period — is surging in popularity. How does earnin app make money? When your paycheck is direct deposited, earnin will deduct the total amount you cashed out plus tips. For hourly workers, you can upload a photo of your daily i found out that my app needed to be deleted and reinstalled. Some companies let you request an advance on your. Earnin says it doesn't charge fees or interest either. This is equal to a 260.71% apr, which is slightly less than there are other ways to access quick cash besides using a payday loan or app like earnin. Have you heard about the earnin app? With earnin, there are no hidden fees. Say goodbye to unfair pay cycles! According to the website, earnin is 95. Earnin is dedicated to helping the community and hardworking people like you to enjoy what you deserve. Earnin is an app that allows you to borrow against your next paycheck quickly without any fees or interest payments attached.

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt

ads/wkwkland.txt

0 Response to "25 Best Images What Is Cash Out On Earnin App - Fintech Business Model Spotlight Earnin Cb Insights Research"

Post a Comment